PayPal Holdings Inc (PYPL)

Traders Started Betting on PayPal's Rally Again

When retail investors watch recent buying and selling activity in the market, they typically can get a pretty strong view of what is happening behind the scenes at some of the industry's largest funds and investment houses. However, reported institutional activity reflects the past, and not the recent one at that, so this information assumes the initial buy thesis has to still be valid for action to be taken on it.

Could Buying PayPal Stock Today Set You Up for Life?

Financial technology, or fintech, is about innovating and finding new ways to move money between people and businesses. PayPal (PYPL 3.22%) is the original fintech stock.

PayPal Holdings, Inc. (PYPL) Is a Trending Stock: Facts to Know Before Betting on It

Paypal (PYPL) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

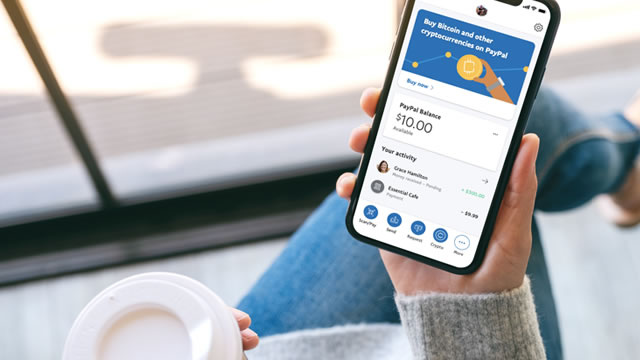

Will PayPal's Deepening Cryptocurrency Footprint Benefit the Stock?

PYPL is doubling down on digital assets with the addition of Chainlink and Solana to its crypto suite.

PayPal Stock: Too Cheap to Ignore, Too Strong to Miss

The tech-heavy NASDAQ is entering bear market territory, as measured by the Invesco QQQ NASDAQ: QQQ, falling 21.85% from its highs as of Apr. 3, 2025.

PayPal: This Selloff Is A Gift

In this article, I go over PayPal today and analyze current valuations. I outline PYPL's major potential revenue and margin growth drivers. I compare a very bearish, a conservative and a very bullish scenario.

Paypal (PYPL) Advances While Market Declines: Some Information for Investors

In the most recent trading session, Paypal (PYPL) closed at $58.53, indicating a +0.27% shift from the previous trading day.

PayPal Brings Personalized Ads Offering to UK Shoppers

PayPal is bringing its PayPal Ads program to the United Kingdom. The solution, first introduced last year in the United States, lets brands and merchants show personalized ads to interested consumers based on previous purchases, according to a Wednesday (April 2) press release.

PayPal Stock's Death Cross Looms - Will It Trigger A Turnaround?

PayPal Holdings Inc. PYPL is on the verge of triggering a Death Cross , a bearish technical signal where the 50-day simple moving average falls below the 200-day moving average.

PYPL "Not in Last Place," Needs to "Pick Up Pace"

"You can't guide weak in this environment," says @LikeFolio's Landon Swan, pointing to weakening consumer sentiment as a headwind against PayPal's (PYPL) outlook. That said, Landon notes traction in Venmo that helps it lean "on the cusp of being great.

Is This Bargain Stock Poised for a Bull Run?

The S&P 500 might be trading 7% below the record high it touched in February, but investors are still concerned about high stock valuations. This makes perfect sense in the wake of the index's strong gains in 2023 and 2024.

Here's Why Paypal (PYPL) Gained But Lagged the Market Today

The latest trading day saw Paypal (PYPL) settling at $65.25, representing a +0.15% change from its previous close.