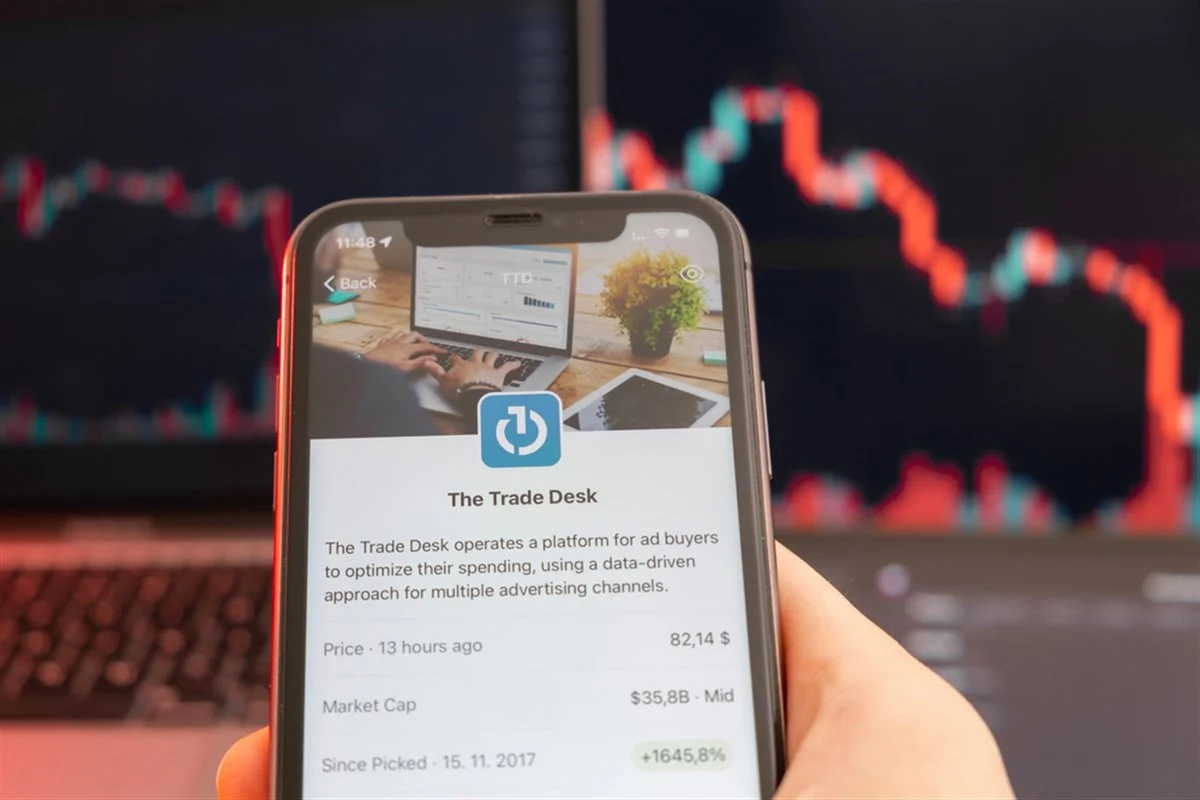

The Trade Desk, Inc. (TTD)

Will Buying The Trade Desk Stock Below $51 Make Investors Rich?

In this video, Motley Fool contributor Jason Hall makes the case for The Trade Desk (TTD 0.18%), which now trades for 25 times adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), and it is still growing at a strong clip despite competitive pressures.

The Trade Desk (TTD) Declines More Than Market: Some Information for Investors

The Trade Desk (TTD) concluded the recent trading session at $50.73, signifying a -1.06% move from its prior day's close.

This stock is up 10% in a week, but U.S. politicians are fleeing

Shares of The Trade Desk (NASDAQ: TTD) have climbed nearly 10% in the past week to $53.90, extending a sharp rebound for the digital advertising platform.

The Trade Desk Is a Great Company, But I'm Not Buying the Stock Yet

The Trade Desk (TTD 1.33%) has long been the independent alternative to the tech giants in the advertising industry. With connected TV (CTV) on the rise, retail media expanding quickly, and advertisers increasingly seeking transparency, the company has carved out a niche as a demand-side platform (DSP).

The Trade Desk: 2 Signs of a Comeback, 1 Risk Ahead

Having suffered a 70% drop followed by a 110% rally within the first eight months of the year, The Trade Desk Inc. NASDAQ: TTD has been one of the most volatile tech stocks of 2025. As we recently highlighted, that rollercoaster hasn't eased since.

The Trade Desk: I Understand AI-Related Risk, But The Selloff Appears Overblown

The Trade Desk is rated a Strong Buy with a $64 price target, implying 28% upside after a 53% stock decline. Despite fierce competition and AI-related concerns, TTD continues to deliver double-digit revenue growth and outperforms peers in profitability and margins. TTD's premium valuation is justified by its high growth, robust cash position, and leading technology in the expanding digital advertising market.

The Trade Desk: Market's Extreme Pessimism Is A Great Buying Opportunity

The Trade Desk stock is once again showing signs of a bottom as buyers return, supporting a solid base above $40. TTD still faces intensifying competition from Amazon and Google, pressuring its premium take rates and challenging its open internet business model. Despite slowing growth, TTD's earnings are not in secular decline, with Wall Street expecting a growth inflection in 2026.

TTD to Rollout Audience Unlimited: Monetization Tailwind Ahead?

The Trade Desk introduces Audience Unlimited and AI-powered trading modes to cut costs and boost ad campaign efficiency.

The Trade Desk Becomes A Fat Pitch Yet Again

I reiterate my buy rating on The Trade Desk despite recent volatility and growth deceleration, seeing the selloff as a buying opportunity. TTD maintains a strong balance sheet with $1.7 billion in cash, no debt, solid GAAP profitability, and attractive profit margins. While growth is slowing due to tariffs and economic uncertainty, I expect sustainable double-digit top-line growth and reasonable long-term valuation.

The Trade Desk: The Pummeling Has Gone Too Far, Buy The Dip

The Trade Desk has fallen nearly 60% in 2025 due to sales execution issues and weaker ad demand, but it remains a market leader in a $1 trillion global ad market. Despite near-term volatility and a CFO transition, I reiterate a buy rating, focusing on TTD's long-term growth potential and strong fundamentals. The company continues to beat its own expectations, and a sales team re-org should help to ensure that growth deceleration isn't too sharp.

The Trade Desk (TTD) Stock Falls Amid Market Uptick: What Investors Need to Know

The Trade Desk (TTD) closed the most recent trading day at $49.01, moving 1.27% from the previous trading session.

Will Live Sports Be the Next Revenue Driver for TTD's CTV Business?

Live sports streaming is becoming integral to The Trade Desk's CTV push, offering advertisers precision targeting during peak moments.