Idacorp Inc. (IDA)

What Makes IdaCorp (IDA) a New Buy Stock

IdaCorp (IDA) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

IDACORP, Inc. (IDA) Q3 2025 Earnings Call Transcript

IDACORP, Inc. ( IDA ) Q3 2025 Earnings Call October 30, 2025 4:30 PM EDT Company Participants Amy Shaw - VP of Finance, Compliance & Risk Lisa Grow - CEO, President & Director Brian Buckham - Senior VP, CFO & Treasurer John Wonderlich Adam Richins - Senior VP & COO Tim Tatum - Vice President of Regulatory Affairs Conference Call Participants William Appicelli - UBS Investment Bank, Research Division Christopher Ellinghaus - Siebert Williams Shank & Co., L.L.C., Research Division Brian Russo - Jefferies LLC, Research Division Anthony Crowdell - Mizuho Securities USA LLC, Research Division Presentation Operator Welcome to IDACORP's Third Quarter 2025 Earnings Call.

IDACORP Q3 Earnings Beat Estimates, Revenues Miss, '25 EPS View Raised

IDA posts higher Q3 earnings despite a revenue dip, lifting its 2025 EPS outlook on customer growth and rate gains.

IdaCorp (IDA) Surpasses Q3 Earnings Estimates

IdaCorp (IDA) came out with quarterly earnings of $2.26 per share, beating the Zacks Consensus Estimate of $2.23 per share. This compares to earnings of $2.12 per share a year ago.

IDACORP Enhances Shareholder Value Through 2.3% Dividend Hike

IDA lifts its dividend again, with the board approving a hike from 86 cents per share to 88 cents.

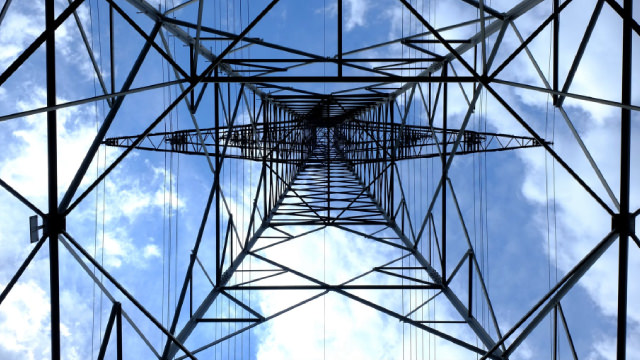

Idacorp: Powering Idaho's Unprecedented Economic Expansion

IDACORP offers low beta, strong long-term growth, and a 3% dividend yield, making it a standout in the energy sector. Idaho's economic and population growth, plus IDACORP's monopoly position and $4B capex plan, drive future earnings potential. Despite recent underperformance and share dilution, valuation remains attractive with a 12% upside and projected 3.1% dividend yield.

Here's Why IDACORP Stock Deserves a Spot in Your Portfolio Right Away

IDA's steady earnings growth, strong balance sheet, rising customer base, and clean energy focus make it a compelling utility investment.

IDACORP Q2 Earnings Match Estimates, Revenues Lag, EPS View Narrowed

IDA posts in-line Q2 earnings and lifts EPS guidance as customer growth drives performance.

IDACORP, Inc. (IDA) Q2 2025 Earnings Call Transcript

IDACORP, Inc. (NYSE:IDA ) Q2 2025 Earnings Conference Call July 31, 2025 4:30 PM ET Company Participants Adam J. Richins - Senior VP & COO Amy I.

IdaCorp (IDA) Meets Q2 Earnings Estimates

IdaCorp (IDA) came out with quarterly earnings of $1.76 per share, in line with the Zacks Consensus Estimate . This compares to earnings of $1.71 per share a year ago.

IdaCorp (IDA) Expected to Beat Earnings Estimates: Should You Buy?

IdaCorp (IDA) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Will IdaCorp (IDA) Beat Estimates Again in Its Next Earnings Report?

IdaCorp (IDA) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.