Swk Holdings Corp. (SWKH)

SWK Holdings Corporation Announces Financial Results for Second Quarter 2024

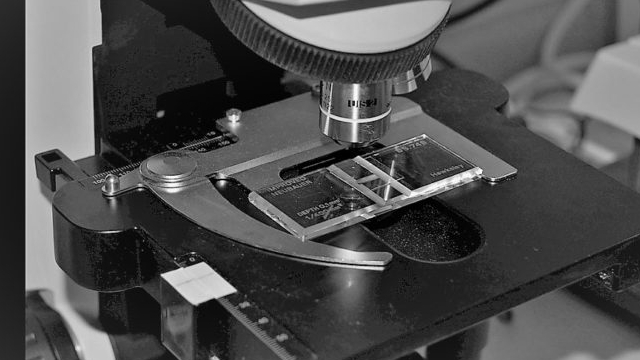

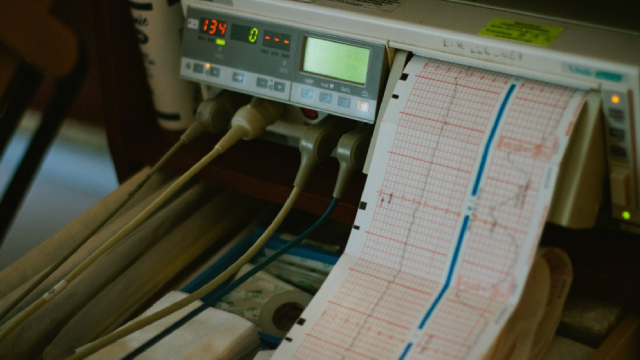

Conference Call Scheduled for Friday, August 16, 2024, at 09:00 a.m. CST Corporate Highlights Second quarter 2024 GAAP net income was $4.4 million, compared with net income of $3.9 million for the second quarter 2023 Second quarter 2024 finance receivables segment adjusted non-GAAP net income was $6.5 million, compared with adjusted non-GAAP net income of $7.6 million for the second quarter 2023 As of June 30, 2024, net finance receivables were $265.5 million, a 19.0% increase from June 30, 2023 The second quarter 2024 effective yield was 14.6%, a 10 bps increase from second quarter 2023 As of June 30, 2024, non-GAAP tangible financing book value per share was $20.17, a 6.3% increase from $18.95 at June 30, 2023 DALLAS, TX / ACCESSWIRE / August 15, 2024 / SWK Holdings Corporation (NASDAQ:SWKH) ("SWK" or the "Company"), a life science-focused specialty finance company catering to small- and mid-sized commercial-stage companies, today provided a business update and announced its financial and operating results for the second quarter ended June 30, 2024.

Here's Why Stanley Black & Decker (SWK) is a Strong Momentum Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Stanley Black & Decker: Strong Q2 Beats Estimates, FY2024 Guidance Upgrade - Turnaround Is Just Getting Started

SWK just reported strong Q2 earnings, beating revenue and earnings expectations. With rate cuts on the horizon, SWK is poised to capitalize upon increased commercial and residential construction activity. Global cost savings plan remains on track to deliver $2 billion by FY2025.

Stanley Black's (SWK) Q2 Earnings Beat, Revenues Down Y/Y

Weakness in the Industrial segment weighs on Stanley Black's (SWK) top line in the second quarter of 2024.

Stanley Black & Decker (SWK) Reports Q2 Earnings: What Key Metrics Have to Say

While the top- and bottom-line numbers for Stanley Black & Decker (SWK) give a sense of how the business performed in the quarter ended June 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Stanley Black & Decker (SWK) Q2 Earnings and Revenues Beat Estimates

Stanley Black & Decker (SWK) came out with quarterly earnings of $1.09 per share, beating the Zacks Consensus Estimate of $0.85 per share. This compares to loss of $0.11 per share a year ago.

Stanley Black (SWK) Surges 6.5%: Is This an Indication of Further Gains?

Stanley Black (SWK) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions could translate into further price increase in the near term.

Stanley Black (SWK) to Report Q2 Earnings: Is a Beat in Store?

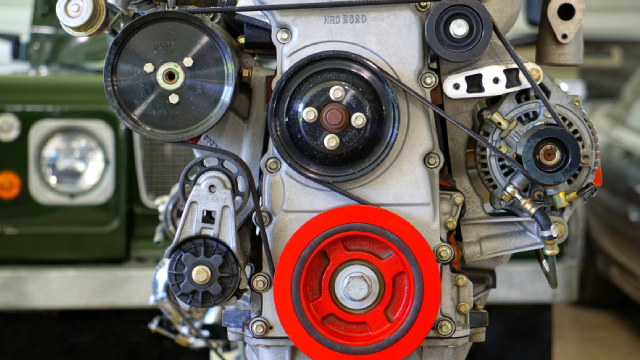

Stanley Black's (SWK) Q2 2024 results are likely to gain from strength in the Engineered Fastening unit. However, the weakness in the Industrial and Tools & Outdoor segments is likely to have adversely impacted its performance.

Stanley Black & Decker (SWK) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Stanley Black & Decker (SWK) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Here's Why It is Appropriate to Retain Stanley Black (SWK)

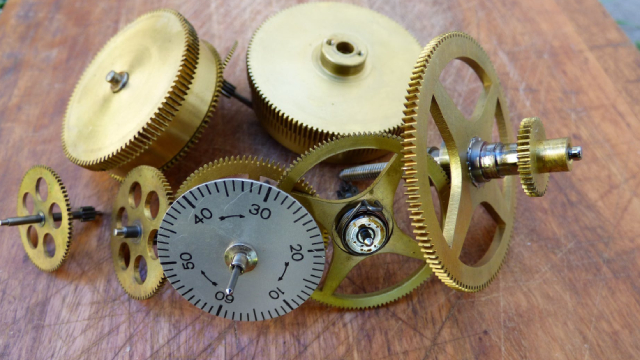

Stanley Black (SWK) is poised to gain from its global cost-reduction program. The company's efforts to reward its shareholders handsomely add to its appeal.

Stanley Black (SWK) Exhibits Strong Prospects Despite Headwinds

Stanley Black (SWK) is set to benefit from its global cost-reduction program. However, weakness in the Industrial segment remains a concern.

SWK Holdings Corporation (SWKH) Q1 2024 Earnings Call Transcript

SWK Holdings Corporation (NASDAQ:SWKH ) Q1 2024 Results Conference Call May 16, 2024 10:00 AM ET Company Participants Jason Rando - Tiberend Strategic Advisors, Inc. Jody Staggs - President and Chief Executive Officer Conference Call Participants Mark Argentino - Lake Street Operator Good morning, everyone, and welcome to the SWK Holdings First Quarter 2024 Conference Call. At this time, all participants have been placed on a listen-only mode, and we will open the floor for your questions and comments after the presentation.